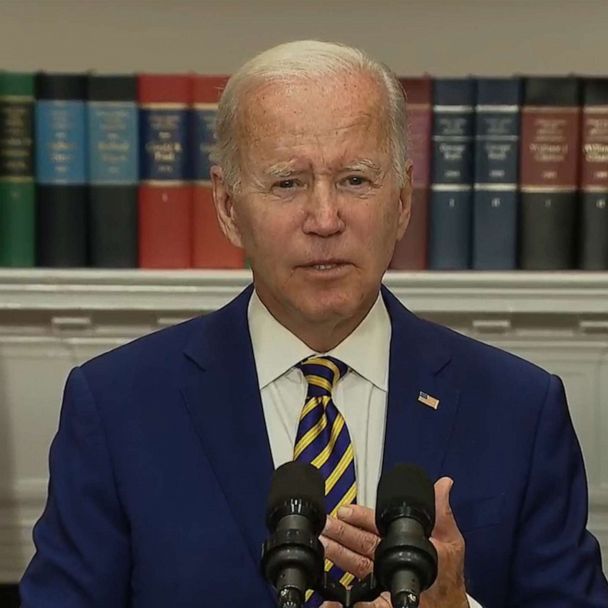

Biden’s loan forgiveness plan aims to alleviate the burden of student debt by providing relief to borrowers. This initiative promises to cancel a certain portion of federal student loans for eligible individuals.

Student loan forgiveness has become a hot topic of discussion in recent years, as the burden of educational debt continues to rise. Recognizing this issue, president joe biden has proposed a loan forgiveness plan to offer relief to borrowers. The plan aims to ease the financial strain on individuals who have accumulated federal student loans by canceling a portion of their debt.

This initiative has generated significant attention and debate, as it holds the potential to make a substantial impact on the lives of millions of americans burdened by student loans. We will delve into the details of biden’s loan forgiveness plan, exploring its eligibility criteria and potential consequences.

Credit: www.motherjones.com

Biden’S Loan Forgiveness Initiative: An Opportunity For Financial Relief

Biden’s loan forgiveness initiative aims to provide financial relief to borrowers, offering an opportunity to alleviate the burden of student loans. This program holds the potential to ease the financial pressures faced by many individuals.

Student loan debt has become a pressing issue for millions of americans, impacting their financial well-being and hindering economic growth. Recognizing this, president joe biden has proposed a loan forgiveness plan that aims to alleviate the burden of student debt and provide individuals with much-needed financial relief.

Let’s delve into the key aspects of biden’s loan forgiveness initiative, including the eligibility criteria, types of student loans covered, and the potential impact it may have on borrowers and the economy.

Eligibility Criteria For Biden’S Loan Forgiveness Plan:

- Graduates who have federal student loans are eligible for loan forgiveness under biden’s plan.

- The initiative primarily targets borrowers who have made regular payments and demonstrated financial hardship.

- Public servants, teachers, and individuals working in non-profit organizations may have additional opportunities for loan forgiveness.

- Eligibility requirements may vary based on income, loan type, and career field.

Income Requirements And Implications:

- Income-based repayment plans are a significant component of biden’s loan forgiveness initiative.

- Borrowers with an income below a certain threshold may qualify for reduced monthly payments, easing their financial burden.

- The plan aims to cap loan repayments at a percentage of the borrower’s discretionary income.

- Lower-income individuals may have the opportunity for full loan forgiveness.

Types Of Student Loans Covered:

- Biden’s loan forgiveness plan focuses on federal loans, such as direct loans, stafford loans, and perkins loans.

- Private student loans and loans obtained through banks or other lending institutions are not eligible for forgiveness under this program.

- The plan seeks to address the majority of outstanding student loan debt, which primarily consists of federal loans.

Understanding The Scope And Impact Of Loan Forgiveness:

- Loan forgiveness has the potential to significantly reduce the debt burden on borrowers.

- It aims to provide financial stability to individuals and promote economic growth by enabling borrowers to invest in other areas such as homeownership, entrepreneurship, and retirement savings.

- By alleviating the financial strain, loan forgiveness can enhance the overall well-being and mental health of borrowers, allowing them to focus on their personal and professional growth.

Reduction Of Debt Burden For Borrowers:

- Loan forgiveness can reduce or eliminate outstanding student loan debt, freeing up income that borrowers can allocate towards other essential expenses.

- For those struggling to make monthly payments, the relief provided by the program can prevent defaults and the associated negative consequences, such as damaged credit scores.

- The initiative aims to grant borrowers the opportunity to achieve financial stability and improve their long-term financial outlook.

Potential Economic Stimulus And Growth:

- Loan forgiveness can stimulate the economy by injecting funds into various sectors.

- With reduced student loan debt, individuals are more likely to contribute to the housing market, consumer spending, and entrepreneurial activities.

- The increased financial security of borrowers can potentially boost economic growth by encouraging investment and job creation.

The Application Process And Necessary Documentation:

- Borrowers will need to submit an application to be considered for loan forgiveness.

- The application process may involve providing relevant documentation, such as proof of income, employment verification, and loan repayment history.

- The department of education will evaluate applications to determine eligibility and the level of forgiveness awarded.

How To Apply For Loan Forgiveness:

- To apply for loan forgiveness, borrowers will need to visit the department of education’s website or a designated portal.

- The application will require personal information, loan details, and supporting documents.

- Careful attention should be given to follow the instructions provided to ensure a smooth and accurate application process.

Required Paperwork And Deadlines:

- Borrowers should gather and prepare the necessary paperwork in advance to facilitate the loan forgiveness application.

- Documentation may include tax returns, pay stubs, w-2 forms, and loan statements.

- It is essential to abide by any specified deadlines to avoid missing out on the opportunity for forgiveness.

Evaluating The Benefits And Potential Drawbacks Of The Program:

- While loan forgiveness offers tremendous benefits to borrowers, it is crucial to consider potential drawbacks.

- Forgiveness programs may only apply to specific types of loans, leaving certain borrowers ineligible.

- Critics argue that loan forgiveness may create moral hazard and incentivize individuals to take on more debt without considering its implications.

- Assessing personal financial circumstances and long-term goals is crucial before committing to any loan forgiveness program.

Alternative Options For Debt Management:

- Individuals who do not qualify for loan forgiveness or wish to explore alternative options can consider various strategies for debt management.

- These include refinancing loans to secure lower interest rates, enrolling in income-driven repayment plans, and seeking professional financial advice.

- Each individual’s situation is unique, and exploring these alternatives can provide valuable insights into managing student loan debt effectively.

Considerations For Future Financial Planning:

- Loan forgiveness should be viewed as an opportunity to achieve long-term financial goals rather than a quick fix.

- It is essential for borrowers to develop a comprehensive financial plan that encompasses saving, investing, and budgeting to ensure future stability and success.

- Wisely managing the funds that would have been allocated for loan payments can pave the way for a stronger financial future.

Success Stories And Testimonials Of Beneficiaries:

- Many individuals have experienced life-changing financial freedom through loan forgiveness programs.

- Success stories provide inspiration and motivation for those who are considering applying for loan forgiveness.

- Beneficiaries often share their experiences of improved financial well-being, reduced stress, and the ability to pursue their dreams.

Real-Life Accounts Of Individuals Affected By Loan Forgiveness:

- Hearing personal stories of those who have directly benefited from loan forgiveness can provide valuable insights.

- Real-life accounts shed light on how the program has positively impacted borrowers’ lives, enabling them to overcome financial hurdles and thrive.

The Life-Changing Impact On Personal Financial Freedom:

- Loan forgiveness can have a profound and transformative effect on an individual’s personal financial freedom.

- The burden of student loan debt can weigh heavily on mental health, relationships, and overall well-being.

- The opportunity for forgiveness offers a fresh start, allowing individuals to take control of their financial lives and pursue their aspirations.

Political And Economic Implications Of Biden’S Loan Forgiveness Plan:

- Biden’s loan forgiveness initiative carries significant political and economic implications.

- Supporters argue that reducing student loan debt aligns with the administration’s commitment to equitable access to education and addressing economic disparities.

- Critics raise concerns over the potential cost and its impact on the economy, including the redistribution of wealth and fairness among taxpayers.

The Rationale Behind The Initiative:

- The high levels of student loan debt and its impact on individuals and the economy have necessitated a comprehensive approach.

- Biden’s loan forgiveness plan aims to address these challenges by providing relief to borrowers and fostering economic growth.

- The initiative reflects a broader commitment to making higher education more accessible and decreasing the financial barriers faced by many.

Criticisms And Counterarguments Against Loan Forgiveness:

- Critics argue that loan forgiveness unfairly benefits those who made choices leading to significant student loan debt.

- Some claim that loan forgiveness overlooks the responsibility of borrowers to manage their debt, potentially undermining personal accountability.

- Counterarguments highlight the systemic issues contributing to the student loan crisis and the need for a solution that addresses the root causes.

Expert Opinions And Analysis On The Long-Term Consequences:

- Experts provide insightful perspectives on the long-term consequences of loan forgiveness.

- Opinions vary, with some experts emphasizing the potential economic benefits, while others express concerns over the implications of such a large-scale forgiveness program.

- In-depth analysis and expert opinions contribute to a more comprehensive understanding of the potential impact on borrowers and the economy.

Financial Experts’ Views On The Effectiveness Of Loan Forgiveness:

- Financial experts often share their perspectives on the effectiveness of loan forgiveness as a solution to the student loan crisis.

- These viewpoints contribute to a well-rounded discussion and offer valuable insights for borrowers and policymakers alike.

Potential Implications For The Education System And Future Generations:

- Loan forgiveness may have far-reaching implications for the education system and future generations of students.

- It could influence decisions on higher education, the availability of loans, and the overall cost of pursuing degrees.

- Considering the ripple effect is essential in evaluating the long-term impact of loan forgiveness on the education landscape.

Legislative Challenges And The Road Ahead:

- Implementing a comprehensive loan forgiveness program faces several legislative challenges.

- Political dynamics and potential opposition from stakeholders may delay or modify the initiative.

- Constant monitoring and adjustment may be required as the program evolves and adapts to changing circumstances.

Political Hurdles And Potential Opposition:

- Political hurdles and potential opposition from various stakeholders can impact the successful implementation of biden’s loan forgiveness plan.

- Opposition may stem from concerns over cost, fairness, or alternative proposals to address student loan debt.

- Negotiation and compromise may be necessary to navigate political hurdles and advance meaningful solutions.

Prospects For Successful Implementation And Expansion Of The Program:

- Despite the challenges, the prospects for successful implementation and expansion of the loan forgiveness program remain substantial.

- The support and momentum behind addressing the student loan crisis provide optimism for meaningful change.

- A proactive approach, stakeholder engagement, and continuous evaluation will be crucial to ensure the program’s success over the long term.

Conclusion

Biden’s loan forgiveness proposal has garnered significant attention and debate. While it aims to provide relief to borrowers burdened by student debt, its implementation and effectiveness remain uncertain. The plan, if enacted, has the potential to alleviate the financial strain on many individuals, allowing them to pursue other life goals such as homeownership or starting a family.

However, critics argue that it may not address the root causes of escalating student loan debt and could have unintended consequences, such as encouraging universities to further increase tuition fees. As this proposal moves forward, it will be crucial to consider its long-term impact and potential alternatives for addressing the broader issue of higher education affordability.

Ultimately, the success of biden’s loan forgiveness plan will rely on finding a balance between providing relief to borrowers and addressing the systemic problems surrounding student loans.

More Stories

Draper 10000 Loan: Unlocking Financial Freedom